Business Owners: Tired of massive tax costs and soaring inflation destroying your profits?

New Blueprint Shows You... "How to Slash Taxes, Double Profits, and Fund Growth"

(Within the next six to nine months!)

COMPLETE YOUR SURVEY BEFORE OUR CALL

Guaranteed!

If you are not 100% delighted with the actionable steps provided for you in The Profit Mastery Blueprint just say the word and we will refund 100% of your purchase price PLUS you can keep your customized Blueprint. We are in the business of helping small businesses thrive!

Eric Kneller "The Prophet of Profit"

Eric Kneller, CEO - Maranatha Consulting

"The Prophet of Profit"

Who is Eric Kneller?

For 15 years Eric traveled the world in an international sourcing and supply chain role where he and his teams drove millions of profit to the bottom line of a 22 billion dollar company. At one point he managed a category of raw materials that represented $400 million in annual spend.

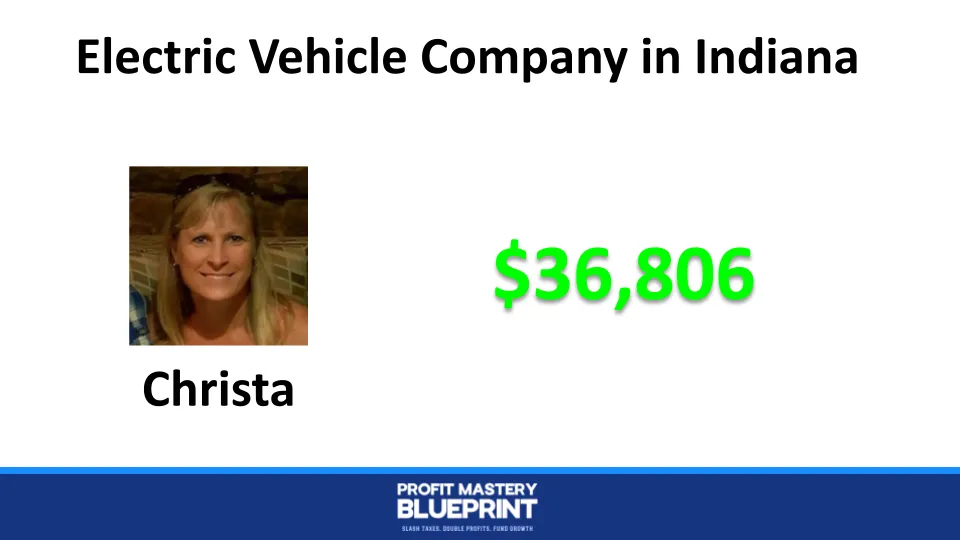

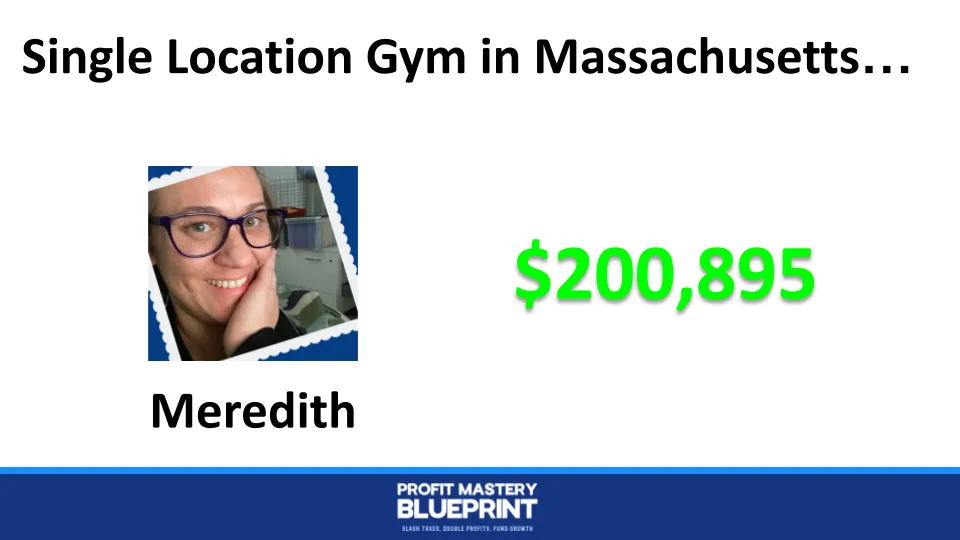

He retired from that career in 2011 and partnered in small businesses start ups to grow them to 7 figures in year one. He knew the power of what he did in large companies could be applied to small business, but there were some obvious differences in size, scope, and available resources. When he launched Maranatha Consulting he did so with a mission to get Millions Back to Main Street! Eric created The Profit Mastery Blueprint and has been rolling it out to business clients across the USA. Owners have been thrilled with the results and he is excited to help as many businesses he can to not only survive, but thrive in these economic times!